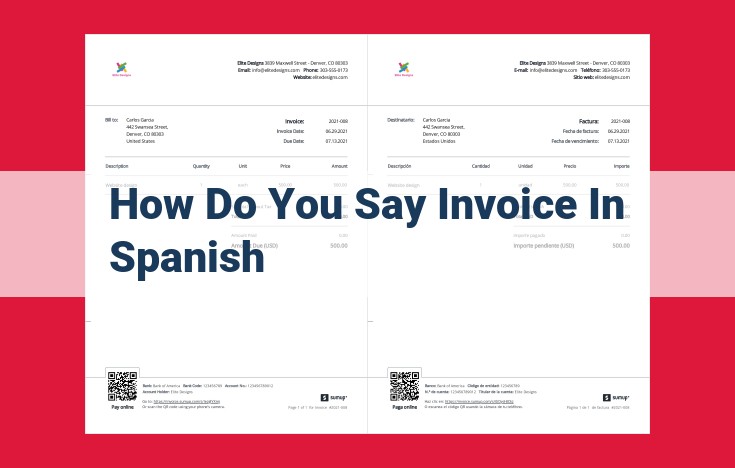

En español, la palabra para “invoice” es “factura”. Es un documento comercial que detalla la venta de bienes o servicios entre dos partes, generalmente un vendedor y un comprador. Contiene información clave como el número de factura, la fecha, la fecha de vencimiento, el importe total y los detalles de los artículos de la línea, así como los datos de las entidades emisora y receptora, los términos de pago y el estado de la factura.

Unveiling the Essence of an Invoice: Key Information Unveiled

An invoice serves as a crucial document in business transactions, providing a comprehensive record of the goods or services rendered and their associated costs. Understanding the key components of an invoice is paramount for both the issuer and recipient.

Essential Elements: A Pillar of Invoice Integrity

At the core of an invoice lies a set of essential elements that provide the foundation for its validity and accuracy. These include:

- Invoice Number: A unique identifier that distinguishes this invoice from others issued by the same company.

- Date: The day the invoice was created and sent to the recipient.

- Due Date: The deadline by which payment is expected to avoid late fees or penalties.

- Total Amount: The grand total of the invoice, inclusive of all line items and applicable taxes.

- Line-Item Details: A breakdown of the products or services provided, including their unit prices, quantities, and extended amounts. These details ensure transparency and accurate billing.

Issuing and Recipient Entities: The Key Players in Invoicing

When it comes to invoicing, identifying the entities involved in the transaction is crucial. These entities play distinct roles in the invoicing process, ensuring the smooth exchange of goods or services and financial settlement.

The Issuing Company (Seller)

The issuing company is the entity that provides the goods or services and issues the invoice. They are responsible for:

- Providing accurate information: This includes their company name, address, contact details, and tax identification number.

- Detailing the transaction: The invoice must clearly state the products or services provided, the quantity, unit price, and total amount.

- Specifying payment terms: The issuing company sets the payment due date, acceptable payment methods, and any applicable discounts or penalties.

The Recipient Company (Buyer)

The recipient company is the entity receiving the goods or services and responsible for making the payment. They are expected to:

- Verify the invoice: The recipient company must review the invoice carefully to ensure the details match the goods or services received.

- Process payment timely: Adhering to the payment terms specified on the invoice is essential to avoid late payment penalties or damage to the business relationship.

- Maintain records: The recipient company should keep a copy of the invoice for their accounting and tax purposes.

By clearly defining the issuing and recipient entities, invoices provide a transparent and legally binding record of the transaction. This helps facilitate efficient communication, payment processing, and dispute resolution between the parties involved.

Invoice Line Items: Breaking Down the Bill

When it comes to invoices, the devil is in the details. And nowhere is that more apparent than in the invoice line items. These are the individual products or services that are being provided, along with their associated unit prices, quantities, and total amounts.

Getting these details right is essential for both the buyer and the seller. For the buyer, it ensures that they’re only paying for what they ordered and that they’re getting the correct price. For the seller, it’s a way of documenting what was sold and when, and it’s also important for tax purposes.

There are a few key pieces of information that should be included in each invoice line item:

- Product or service description: A brief description of what is being sold, including any relevant details such as the model number, size, or color.

- _Quantity: The number of units of the product or service that is being sold.

- Unit price: The price per unit of the product or service.

- Total amount: The total cost of the product or service, calculated by multiplying the unit price by the quantity.

In addition to these key pieces of information, invoice line items may also include other details such as:

- _Discounts: Any discounts that are being applied to the product or service.

- _Taxes: Any taxes that are being applied to the product or service.

- _Shipping and handling charges: Any charges for shipping and handling the product or service.

By including all of these details in the invoice line items, both the buyer and the seller can have a clear understanding of what is being sold, at what price, and with what additional costs. This can help to avoid misunderstandings and disputes down the road.

Financial Details: The Nuts and Bolts of Your Invoice

When it comes to invoices, financial details play a crucial role in ensuring clarity and accuracy. These details paint a clear picture of the transaction, helping both parties understand the financial obligations involved.

Tax Calculations: Unraveling the Tax Labyrinth

Tax calculations are an essential component of any invoice. They ensure that the appropriate taxes are applied to the products or services provided. Different types of taxes, such as sales tax or value-added tax (VAT), may apply depending on the jurisdiction and the nature of the transaction.

Discounts Applied: Rewarding Loyalty and Early Payments

Discounts offer a way to reward customers for their loyalty or prompt payments. They can be applied as a percentage or a fixed amount, and can significantly reduce the total invoice amount. When discounts are applied, it’s important to clearly specify the terms and conditions associated with them.

Payment Terms: A Clear Understanding of When and How

Payment terms outline the expected time frame and methods for settling the invoice. They typically specify the due date, which is the last day on which payment can be made without penalty. Payment terms also include details on the acceptable payment methods, such as bank transfer, check, or credit card.

By providing a comprehensive breakdown of these financial details, invoices enhance transparency and facilitate efficient payment processing. Understanding these elements ensures that both parties have a clear and accurate record of the transaction and their respective financial responsibilities.

Payment Processing: The Key to Hassle-Free Invoicing

When you send out an invoice, you’re not just asking for money. You’re also starting a payment process that can have a big impact on your business. That’s why it’s important to get it right.

The payment processing section of your invoice should include the following information:

- Acceptable payment methods: Let your customers know what forms of payment you accept. This could include checks, credit cards, PayPal, or wire transfer.

- Payment due dates: Make sure to include a clear payment due date on your invoice. This will help to avoid confusion and late payments.

- Any other relevant information regarding payment: Do you offer discounts for early payment? Do you have a late payment fee? Be sure to include any important information that your customers need to know.

By following these tips, you can create a payment processing section that will help to make your invoicing process smoother and more efficient.

Tips for Streamlining Your Payment Processing

In addition to the information above, there are a few other things you can do to streamline your payment processing:

- Use an invoicing software: Invoicing software can help you to automate many of the tasks associated with payment processing, such as sending invoices, tracking payments, and generating reports.

- Offer online payment options: Online payment options make it easy for your customers to pay their invoices. You can add a payment button to your invoices or send them a link to a secure payment page.

- Follow up on late payments: If you have a customer who is late on a payment, don’t be afraid to follow up. A friendly reminder can often help to get the payment processed quickly.

By following these tips, you can create a payment processing system that will help you to get paid faster and more efficiently.

Tracking Invoice Status: A Guide to Invoice Management

An invoice serves as a crucial financial document that needs constant monitoring to ensure timely payments and accurate record-keeping. Understanding the various statuses of an invoice is essential for businesses to manage their cash flow effectively.

Unpaid Invoices:

The initial status of an invoice is unpaid. It indicates that the customer has not yet submitted payment for the goods or services provided. Keeping track of unpaid invoices is vital to prevent late payments and potential disputes. Regular follow-ups and reminders can help expedite payment.

Partially Paid Invoices:

When a customer makes a partial payment against an invoice, its status changes to partially paid. This situation requires careful attention to ensure the remaining balance is cleared in a timely manner. Sending reminders and checking payment records are essential to avoid misunderstandings and delays.

Fully Paid Invoices:

The most desirable status for an invoice is fully paid. It signifies that the customer has settled the entire amount due. Businesses should keep a record of fully paid invoices for accounting purposes and to maintain a positive relationship with their customers. Archiving and tracking paid invoices can also assist in resolving any potential queries or disputes.

Monitoring Invoice Status:

Regularly reviewing and monitoring invoice statuses is crucial for financial health. Using an accounting software or invoice management system can automate this process and provide valuable insights into payment patterns and cash flow forecasts. Effective invoice status management can improve business efficiency, reduce payment delays, and strengthen relationships with customers.

Tips for Tracking Invoice Status:

- Set clear payment terms: Communicate payment deadlines and consequences for late payments upfront.

- Offer multiple payment options: Provide customers with convenient payment methods to increase payment speed.

- Automate reminders: Utilize technology to send automated reminders for unpaid and partially paid invoices.

- Provide invoice tracking: Allow customers to track invoice status online or through a dedicated portal.

- Follow up promptly: Reach out to customers who have missed payment deadlines in a timely and professional manner.