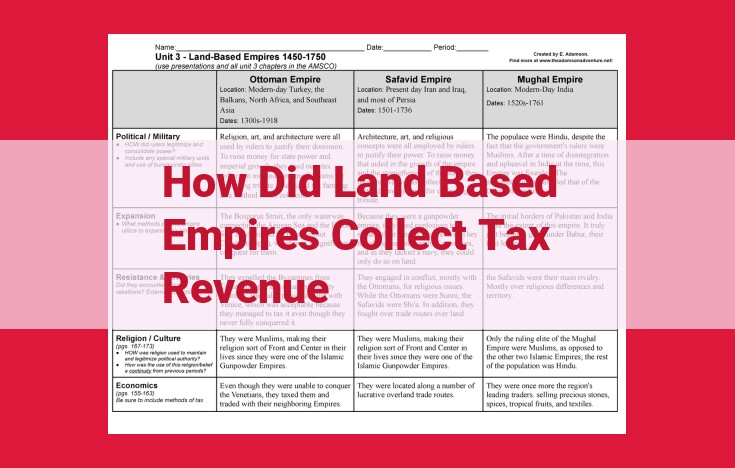

Land-based empires collected tax revenue through diverse methods. Taxing authorities, royal courts, and bureaucracies levied taxes on landowners, peasants, and merchants. Local officials and tax collectors played crucial roles in collection using methods such as land taxes, sales taxes, and customs duties. Tax rolls and records documented assessments and collections. Currency and infrastructure facilitated transactions, while legal frameworks and enforcement mechanisms ensured compliance. Specialized roles, including accountants, supported the taxation process.

Taxing Entities

- Discuss the different government structures involved in taxation, including taxing authorities, royal courts, and bureaucracies.

Taxing Entities: The Powers that Govern our Contributions

Throughout history, taxation has been an essential tool for governments to fund their operations and provide services to their citizens. The structures responsible for collecting and administering taxes have evolved over time, reflecting the changing nature of government and society.

In ancient times, taxing authorities were often decentralized. Local officials, such as village elders or tribal leaders, had the power to levy taxes on their communities. As governments became more centralized, so too did the collection of taxes. In ancient Egypt, for example, the Pharaoh had ultimate authority over taxation, with a complex bureaucracy responsible for its administration.

In medieval Europe, royal courts played a significant role in taxation. Kings and queens imposed taxes on their subjects, often with the consent of a representative assembly. In England, the Magna Carta of 1215 established the principle that no taxes could be levied without the approval of Parliament.

As states grew in size and complexity, bureaucracies emerged to handle the administration of taxation. In China, the Imperial Ministry of Revenue was responsible for collecting taxes from all over the vast empire. In Europe, the development of national tax administrations led to the creation of specialized agencies such as the French Bureau de la Taille and the British Board of Inland Revenue.

The evolution of taxing entities has been driven by a variety of factors, including the need for increased revenue, the desire for greater efficiency, and the changing demands of society. Today, tax authorities around the world continue to play a vital role in funding essential public services, from healthcare and education to infrastructure and national defense.

Taxpayers: The Backbone of Taxation

In the intricate tapestry of taxation, there existed a diverse cast of individuals who bore the financial burden of supporting their communities and governments. These taxpayers were the backbone of the system, their contributions essential for the functioning of society.

Landowners: Pillars of Stability

Among the foremost taxpayers were landowners, whose vast estates and fertile fields provided a steady source of revenue. They were the aristocracy, the wealthy elite who held sway over vast territories. Their agricultural holdings generated significant income, which was often taxed at a substantial rate.

Peasants: The Toiling Masses

Another large group of taxpayers was the peasantry. These humble farmers worked diligently to cultivate the land, producing crops that fed not only themselves but also the entire population. Their earnings, though modest, were subject to various taxes, such as land taxes and tithes.

Merchants: Engines of Commerce

Merchants, the lifeblood of trade, played a vital role in the economy. They transported goods and services from far-off lands, facilitating the exchange of wealth and ideas. Their profits were taxed by customs duties and sales taxes, contributing to the coffers of the state.

Artisans: Skilled Contributors

Artisans, with their deft hands and specialized skills, crafted exquisite goods that enriched society. Their income, derived from their labor and creativity, was subject to occupation taxes. These taxes recognized the value they brought to the community.

Slaves and Serfs: The Unfortunate

In some societies, slaves and serfs were also subjected to taxation. Their labor, often unpaid and arduous, was taxed through head taxes and poll taxes. These taxes were a cruel reminder of their servitude and lack of freedom.

Uncovering the Unsung Heroes of Taxation: The Tax Collectors

In the tapestry of history, the intricacies of taxation have played a crucial role in shaping societies and economies. While the focus often falls on the imposing figures of rulers and lawmakers, the true unsung heroes of this complex system are the tax collectors, the individuals responsible for collecting the lifeblood of any government.

In ancient times, local officials, appointed by the taxing authority, were entrusted with the daunting task of extracting taxes from the populace. These humble individuals were often the first point of contact between the government and its citizens, tasked with the unenviable job of enforcing the law and ensuring a steady flow of revenue.

As societies grew more complex, so too did the role of tax collectors. In medieval Europe, for instance, the sheriff emerged as a powerful figure responsible for collecting taxes, maintaining order, and enforcing justice. Often appointed by the king, sheriffs possessed wide-ranging authority, including the power to seize property and imprison those who failed to pay their dues.

In later centuries, as bureaucracies expanded, the task of tax collection became increasingly specialized. Revenue officers were appointed to manage specific taxes, such as land taxes, customs duties, and excise taxes on goods. These officials were often highly skilled and knowledgeable, responsible for ensuring accurate assessments and efficient collection.

The methods employed by tax collectors varied widely depending on the time and place. In the ancient world, land taxes were common, with landowners being assessed based on the size and value of their property. Sales taxes and customs duties were also widely used, particularly in coastal areas where trade flourished.

As commercial activity increased, tax collectors developed more sophisticated methods of collection. Tax rolls were introduced to document assessments and payments, ensuring accountability and transparency. In some cases, contractors were hired to collect taxes, often under strict oversight to prevent fraud and abuse.

The role of tax collectors was not without its challenges. In times of economic hardship or political turmoil, tax collection could be a hazardous endeavor. Collectors often faced resistance, threats, and even violence from those who resented the burden of taxation.

Despite the inherent difficulties, tax collectors played an essential role in maintaining the stability and prosperity of societies throughout history. Their efforts ensured the funding of public services, from roads and bridges to schools and hospitals. Without their dedication and expertise, the wheels of civilization would have ground to a halt.

Today, as the tax landscape continues to evolve, the role of tax collectors remains as crucial as ever. Whether they are modern-day IRS agents or revenue officers in developing countries, these individuals are responsible for ensuring the fair and efficient collection of taxes that fund essential government functions.

As we navigate the complexities of taxation in the 21st century, let us not forget the unsung heroes who have toiled tirelessly for centuries, collecting the resources that make our communities thrive.

Methods of Tax Collection: A Historical Journey

Throughout history, governments have employed a diverse array of methods to collect taxes, each with its unique characteristics and implications. Delving into these methods provides a fascinating glimpse into the ways in which societies have financed their operations.

Land Taxes: A Foundation of Revenue

One of the oldest forms of taxation is the land tax, levied on the ownership or use of land. This tax places a burden primarily on landowners, who are assessed based on the size, quality, and productivity of their holdings. In many early civilizations, land taxes were the backbone of government revenue, supporting essential services and infrastructure.

Sales Taxes: Transactions and Trade

Another common method of tax collection is the sales tax, imposed on the purchase of goods and services. This tax is typically collected at the point of sale and can vary significantly by jurisdiction. Sales taxes are a major source of revenue for many modern governments, and their impact on consumers and businesses is a subject of ongoing debate.

Customs Duties: A Gateway to Revenue

Customs duties are taxes levied on goods imported or exported across borders. These duties serve two primary purposes: to generate revenue for the government and to protect domestic industries from foreign competition. Historically, customs duties played a crucial role in financing international trade and were a significant source of wealth for maritime nations.

Beyond these core methods, governments have also employed a variety of other tax collection strategies, including:

- Poll taxes levied on each adult citizen, regardless of income or wealth.

- Excise taxes imposed on the production or sale of specific goods, such as alcohol, tobacco, or gasoline.

- Luxury taxes targeting high-value items, such as jewelry, yachts, or exotic cars.

The choice of tax collection method depends on a variety of factors, including the political, economic, and social context of the time. As societies evolved, so too did their tax collection systems, reflecting changing priorities and technological advancements.

Tax Records: The Vital Documentation of Tax Administration

In the intricate tapestry of taxation, meticulous record-keeping plays a pivotal role in ensuring transparency, accountability, and the smooth functioning of the tax system. Tax records serve as indispensable tools for documenting tax assessments and collections, providing a reliable and verifiable historical account of the tax process.

Tax Rolls: The Foundation of Tax Records

Tax rolls, comprehensive lists of taxpayers and their assessed taxes, form the backbone of tax records. These documents provide a detailed breakdown of each taxpayer’s tax liability, including the type of tax, the taxable property or income, and the calculated amount of tax due. Tax rolls are meticulously maintained by tax authorities, with each entry carefully recorded and cross-referenced.

Other Essential Tax Records

Beyond tax rolls, various other records are indispensable in the tax administration process. Account books, for example, meticulously track all transactions related to tax collection and disbursement, ensuring financial accountability. Assessment notices document the specific amount of tax owed by each taxpayer, while receipts provide proof of payment. These records collectively paint a comprehensive picture of the tax process, from assessment to collection.

The Importance of Tax Records

Tax records are not mere pieces of paper; they are vital instruments that serve several crucial purposes:

- Legal Validity: Tax records provide legal proof of tax assessments and collections. They serve as evidence in tax disputes, ensuring that taxpayers fulfill their obligations while protecting their rights.

- Auditability: Tax records enable independent audits to verify the accuracy and compliance of tax assessments and collections. This transparency enhances accountability and supports the integrity of the tax system.

- Historical Documentation: Tax records provide invaluable historical data that helps researchers and policymakers understand past tax policies and their impact on society. They contribute to a rich understanding of the evolution of taxation and its role in economic and social development.

Tax records are not merely bureaucratic necessities; they are essential components of a well-functioning tax system. Their meticulous maintenance ensures transparency, accountability, and the preservation of tax history. These records empower taxpayers, protect their rights, and support the efficient administration of taxation. By recognizing the crucial role of tax records, we can strengthen the foundation of our tax systems and foster a society that values both tax compliance and fair taxation.

Currency and Infrastructure: The Backbone of Tax Collection

The Flow of Currency

In ancient tax systems, currency played a pivotal role in the collection and administration of taxes. Taxes could be paid in a variety of forms, including coinage, bullion, or agricultural produce. The type of currency accepted varied depending on the region and time period.

Infrastructure for Tax Administration

To support the collection and management of taxes, governments developed intricate infrastructure. This infrastructure included systems for assessment, record keeping, and enforcement. Tax rolls, ledgers, and other documents were meticulously maintained to track tax assessments and collections.

Coinage Production

The production of coinage was a significant undertaking that required specialized infrastructure. Mints were established to produce coins of standardized weight and purity. This ensured the uniformity of currency and facilitated tax collection.

Roads and Transportation

Roads and transportation networks were essential for the efficient movement of tax collectors and the transportation of tax revenue. Bridges, toll roads, and inns were constructed to support the infrastructure of tax collection.

Warehouses and Storage Facilities

In some cases, warehouses and storage facilities were used to hold agricultural produce or other goods that were accepted as payment of taxes. These facilities helped to manage and protect the collected tax revenues.

By establishing a robust currency system and supporting infrastructure, ancient governments were able to effectively collect and administer taxes. This infrastructure laid the foundation for modern tax systems and ensured the financial stability of societies throughout history.

Law and Enforcement: The Bedrock of Taxation

Throughout history, the concept of taxation has been intertwined with a robust legal and regulatory framework. These frameworks establish the rules and regulations that govern the imposition, collection, and enforcement of taxes.

Tax Codes: The Blueprint for Taxation

At the heart of tax law lies the tax code, a comprehensive document that outlines the types of taxes, tax rates, and exemptions. This code serves as a roadmap for taxing authorities, taxpayers, and tax professionals alike. It ensures that taxes are levied fairly and equitably, according to established principles.

Enforcement Mechanisms: Maintaining Compliance

To ensure compliance with tax laws, governments have established a range of enforcement mechanisms. These mechanisms may include audits, penalties, and criminal prosecutions. By imposing these consequences, governments deter tax evasion and protect the integrity of the tax system.

Legal Challenges: The Struggle for Interpretation

Tax codes are often complex and subject to interpretation, leading to disputes between taxpayers and taxing authorities. To resolve these disputes, tax courts or tribunals have been established. These bodies adjudicate tax-related cases, ensuring that tax laws are applied fairly and consistently.

The Role of Accountants: Skilled Interpreters

In the realm of taxation, specialized individuals known as accountants play a vital role in deciphering tax codes and advising clients on compliance. Their expertise enables businesses and individuals to navigate the often-complex tax landscape, ensuring that they meet their tax obligations while optimizing their financial position.

By establishing a robust legal and regulatory framework, governments have created a system that ensures the fair and efficient collection of taxes. This framework provides the foundation for a stable and equitable society, where citizens and businesses alike contribute their share to the public good.

The Specialized Roles in Taxation: Accountants and Beyond

In the intricate world of taxation, specialized individuals play crucial roles that streamline the process and ensure accuracy and compliance. Among these specialists, the role of accountants stands out.

Accountants possess a deep understanding of accounting principles, financial reporting, and tax regulations. They work closely with businesses and individuals to prepare financial statements, calculate tax liabilities, and file tax returns. Their expertise ensures that tax obligations are met accurately and efficiently, minimizing the risk of errors and penalties.

Beyond accountants, other specialized individuals also contribute to the seamless functioning of the taxation process. Tax attorneys provide legal guidance and interpret tax laws, ensuring that all parties are compliant. Tax auditors conduct independent reviews of tax records, verifying the accuracy of reported information and identifying areas for improvement. Tax economists analyze the economic impact of tax policies and advise governments on tax reforms.

These specialized roles play a vital part in maintaining the integrity of the taxation system. Their knowledge and expertise allow them to navigate the complexities of tax regulations, ensuring that all stakeholders fulfill their tax obligations and that the tax burden is distributed fairly.

In today’s increasingly complex financial landscape, specialized individuals in taxation are more important than ever. Their expertise empowers businesses and individuals to make informed decisions, maximize tax savings, and confidently navigate the taxing maze.